Boost Sales and Customer Satisfaction: The 12 Best Payment Gateways for Shopify

When setting up an online store with Shopify, one of the most critical decisions you’ll need to make is choosing the right payment gateway.

The best payment methods for Shopify are ones that allow your customers to choose how they want to pay and help ensure a smooth online shopping experience.

Moreover, they help you establish credibility with potential and current clients. This comprehensive guide by vkommerce will explore the 12 best payment method for Shopify.

Whether you’re just starting your Shopify store or looking to optimize your existing payment setup, this article will provide valuable insights and help you make informed decisions.

What are Shopify Payment Methods?

Let’s define Shopify payment methods before getting into the details. These are the many methods your customers can use to pay for their purchases on your store.

Credit cards, digital wallets, and other payment channels are just a few of the alternatives available through these techniques.

Best payment method for Shopify: Key factors to consider

Choosing the best payment gateway for Shopify store is a critical decision. Here are some key factors to consider:

1. Security

Security is paramount when it comes to online payments. Make sure your payment method is secure to protect both your business and your customers’ sensitive information.

2. Transaction Fees

Different payment methods come with other fee structures. Remember to consider transaction fees for each option and how they can affect your profits.

3. Payment Processing Time

Consider how quickly funds are deposited into your account after a successful transaction.

Faster processing times can be beneficial for maintaining healthy cash flow.

4. User Experience

The payment process should be seamless and user-friendly to minimize cart abandonment rates.

Ensure that the selected payment methods integrate smoothly with your Shopify store.

5. Geographic Coverage

If your business operates internationally, make sure your chosen payment methods are accessible to customers in your target regions.

12 Best Payment Method for Shopify (Pros & Cons)

Now, let’s check out the top 12 payment methods for Shopify in 2023, review their features, and discuss their pros and cons to help you decide.

1. Shopify Payments

Shopify Payments is Shopify’s native payment processing solution, designed to integrate with your Shopify store seamlessly.

It’s the default option for many Shopify store owners due to its convenience and ease of use.

Key Features:

- Seamlessly integrated with Shopify.

- Low transaction fees (with no additional charges for using external gateways).

- Supports multiple currencies.

- Automatic syncing of payments and orders.

- Provides a unified dashboard for managing orders and payments.

Pros:

- Seamlessly integrated with Shopify, reducing setup complexity.

- Low transaction fees, which can save you money.

- Supports multiple currencies, allowing you to sell internationally.

- Automatic syncing simplifies order management.

- Unified dashboard for a streamlined administrative experience.

Cons:

- Available in a limited number of countries.

- May not support high-risk industries.

2. PayPal

PayPal is one of the best payment provider for Shopify. It’s a well-known and trusted payment platform for safe online payments worldwide.

It’s known for its widespread adoption and user-friendly interface.

Key Features:

- Widely recognized and trusted by customers.

- Offers PayPal One Touch for faster checkouts.

- Supports international transactions.

- No setup or monthly fees.

Pros:

- Widely recognized and trusted, enhancing customer confidence.

- PayPal One Touch streamlines the checkout process.

- International support expands your customer base.

- No setup or monthly fees reduce upfront costs.

Cons:

- Transaction fees can be relatively high, especially for international payments.

- Requires customers to leave your site to complete the payment.

3. Stripe

Stripe is a developer-friendly payment gateway known for its robust APIs and extensive currency support.

It’s a popular choice for businesses with specific customization needs.

Key Features:

- Developer-friendly with robust APIs.

- Supports over 135 currencies.

- Seamless integration with Shopify.

- Competitive pricing and no monthly fees.

Pros:

- Developer-friendly, allowing for tailored solutions.

- Wide currency support for international sales.

- Seamless integration with Shopify simplifies setup.

- Competitive pricing helps manage costs.

Cons:

- Some businesses may find Stripe’s risk assessment stringent.

4. Authorize net

Authorize Net is a reliable and secure payment gateway suitable for businesses of all sizes and industries. High-risk companies especially favour it.

Key Features:

- Reliable and secure payment gateway.

- Accepts multiple payment methods.

- Offers a virtual terminal for in-person payments.

- Suitable for high-risk industries.

Pros:

- Reliability and security are paramount.

- Accepts various payment methods for customer convenience.

- Virtual terminal extends payment options to in-person transactions.

- Ideal for high-risk industries where security is critical.

Cons:

- Transaction fees can be relatively high for smaller businesses.

- Requires a separate merchant account.

5. Opayo

Opayo, formerly Sage Pay, is a payment gateway focusing on solid fraud prevention tools. It’s a choice for businesses prioritizing security.

Key Features:

- Strong fraud prevention tools.

- Supports multiple payment methods.

- Offers tokenization for secure payments.

- Suitable for businesses of all sizes.

Pros:

- Strong fraud prevention tools enhance security.

- Supports multiple payment methods to accommodate diverse customers.

- Tokenization adds an extra layer of payment security.

- Suitable for businesses of all sizes.

Cons:

- Transaction fees may not be the most competitive.

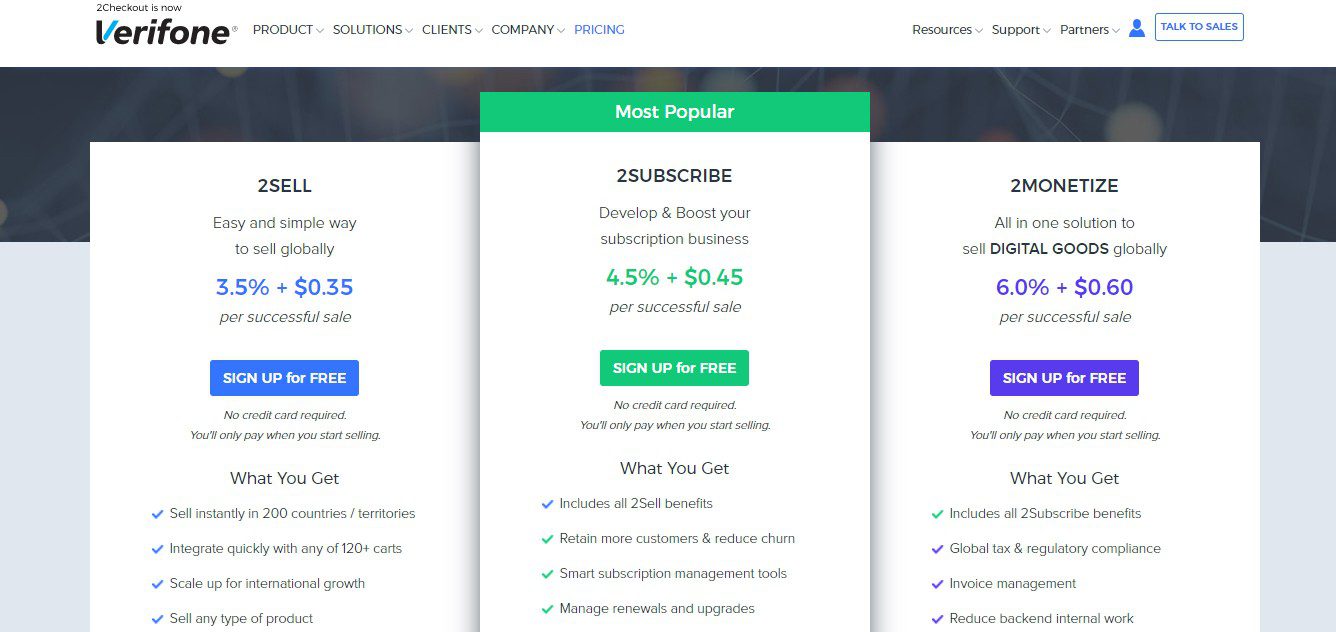

6. Verifone

Verifone is a secure and reliable payment processing solution known for its wide range of payment method support.

It’s often chosen for its established reputation.

Key Features:

- Secure and reliable payment processing.

- Supports a wide range of payment methods.

- Strong customer support.

Pros:

- Security and reliability are top priorities.

- Broad payment method support caters to diverse customers.

- Strong customer support ensures assistance when needed.

Cons:

- Transaction fees can vary depending on your business’s size and needs.

7. WorldPay

WorldPay provides global payment solutions with multiple integration options and robust fraud prevention tools.

It’s suitable for businesses with a worldwide presence.

Key Features:

- Global payment solutions.

- Multiple integration options.

- Supports various payment methods.

- Offers fraud prevention tools.

Pros:

- Global payment solutions facilitate international expansion.

- Multiple integration options provide flexibility.

- Diverse payment method support meets customer preferences.

- Fraud prevention tools enhance security.

Cons:

- Pricing may not be transparent and could include hidden fees.

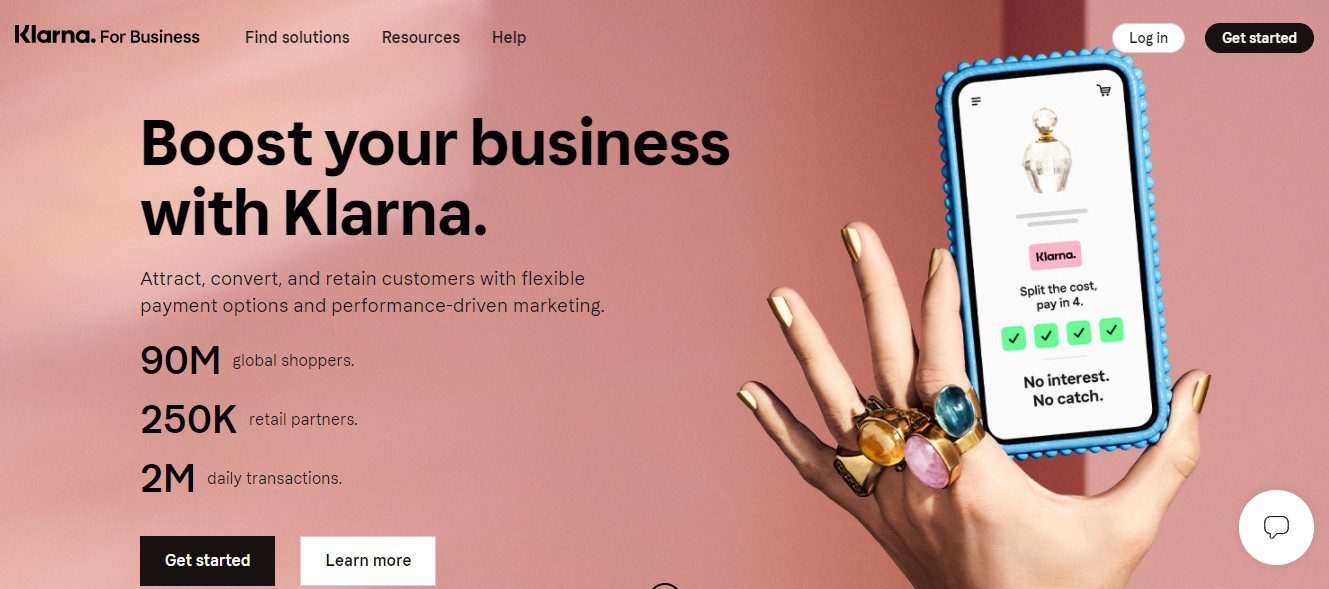

8. Klarna

Klarna is known for its “Buy Now, Pay Later” option, which can boost conversion rates by offering flexible payment options.

It’s a choice for businesses aiming to improve the customer shopping experience.

Key Features:

- Popular “Buy Now, Pay Later” option.

- Increases conversion rates with flexible payment options.

- No setup or monthly fees for merchants.

Pros:

- The “Buy Now, Pay Later” option improves conversion rates.

- Flexible payment options cater to different customers.

- No setup or monthly fees reduce initial expenses for merchants.

Cons:

- Limited to certain countries and industries.

- It may only be suitable for some business models.

9. Square

Square provides easy setup for in-person and online payments, making it an excellent choice for businesses of all sizes.

It’s known for its user-friendly hardware options.

Key Features:

- Easy setup for in-person and online payments.

- Transparent pricing with no monthly fees.

- Offers various hardware options for in-person sales.

Pros:

- Easy setup accommodates businesses of all sizes.

- Transparent pricing simplifies cost management.

- Hardware options enhance in-person sales capabilities.

Cons:

- Limited international support.

- Transaction fees may not be the most competitive for high-volume businesses.

10. Amazon Pay

Amazon Pay is the best payment provider for Shopify. It is a trusted payment method that offers Amazon customers a fast and secure checkout experience.

It leverages Amazon’s widespread user base.

Key Features:

- Trusted by Amazon customers.

- Offers fast and secure checkout.

- No setup or monthly fees.

Pros:

- Trusted by Amazon customers, instilling confidence.

- Fast and secure checkout enhances the shopping experience.

- No setup or monthly fees reduce initial costs.

Cons:

- Limited to Amazon customers, potentially excluding some of your target audience.

- Transaction fees can be higher for lower-value transactions.

11. Braintree

Braintree, owned by PayPal, offers reliable payment processing with support for various payment methods, including mobile wallets.

It’s a choice for businesses seeking a trusted solution with diverse payment options.

Key Features:

- Owned by PayPal, offering Reliability.

- Supports various payment methods, including mobile wallets.

- Transparent pricing.

Pros:

- Backed by PayPal, instilling trust.

- Diverse payment method support caters to various customers.

- Transparent pricing simplifies cost management.

Cons:

- Stripe may be more developer-friendly.

- Transaction fees can add up for high-volume businesses.

12. Adyen

Adyen is an international payment processing solution that supports numerous payment methods and provides advanced fraud prevention.

It’s a choice for businesses operating on a global scale.

Key Features:

- International payment processing.

- Supports numerous payment methods.

- Provides advanced fraud prevention.

Pros:

- International payment processing facilitates global operations.

- Extensive payment method support meets customer preferences.

- Advanced fraud prevention enhances security.

Cons:

- May not be suitable for small businesses due to pricing.

- Requires technical expertise for setup.

I hope this list of the Best payment gateway for Shopify have been helpful for you.

Now you will get the Shopify payment gateway which will best fit your Shopify store.

Choosing the Best Payment Gateway for Shopify

If you want to explore the world of e-commerce and wondering why Shopify stands out as a top choice, don’t miss our comprehensive blog on:

Why Shopify – Features, It delves into the array of features that make Shopify a leading platform for online businesses.

Now that you know the good and bad sides of these top 12 payment methods for Shopify, you can choose the one that fits your business best.

Consider factors such as:

- Your target audience

- The countries you operate in

- Transaction volumes

- Your budget

Remember that the right choice can increase sales and improve customer satisfaction and overall business success.

Want to enhance your Shopify store’s payment options?

Don’t forget to explore our Best Shopify development services for seamless integration and customization.

FAQ’s

1. What Payment Processor Does Shopify Use?

Shopify mainly uses its internal payment processing platform, “Shopify Payments.” To provide users freedom, it also gives interfaces several third-party payment gateways.

Many business owners use Shopify Payments by default because it provides a simple and integrated payment option within the Shopify platform.

It offers a simple setup process and supports all major credit and debit cards. That’s why “Shopify Payment” is said to be the best payment provider for Shopify.

2. Which Payment Method is Best for Shopify?

The best payment method for Shopify depends on your specific business needs, target audience, and geographical location. Here are some popular options to consider:

- Shopify Payments

- PayPal

- Stripe

- Authorize Net

Ultimately, the best payment method for Shopify aligns with your business goals, customer preferences, and the markets you serve.